1. Introduction

What is spot trading on Binance? Spot trading on Binance is a popular method for buying and selling cryptocurrencies at current market prices. Whether you’re a beginner or an experienced trader, understanding the ins and outs of spot trading can help you make informed decisions and maximize your profits. In this comprehensive guide, we’ll cover everything you need to know about spot trading on Binance, including key concepts, strategies, common mistakes to avoid, and resources for further learning. Dive in and discover how you can start trading confidently on one of the world’s leading cryptocurrency exchanges.

Table of Contents

2. What is Spot Trading?

Spot trading involves the immediate exchange of cryptocurrencies at the current market price. In spot markets, transactions occur directly between buyers and sellers, with the ownership of the financial assets transferring from one party to another. When you place a buy or sell order on Binance Spot, you are engaging in spot trading.

How spot trading works

In traditional markets, spot trading typically involves commodities, currencies, or securities. For example, if you buy gold in a spot trade, you pay the current market price and receive the gold immediately. Similarly, in the cryptocurrency world, spot trading on Binance follows the same principle. When you engage in spot trading on Binance, such as buying Bitcoin, you exchange it for another cryptocurrency or fiat currency at the current market price. The bitcoin is then transferred to your Binance wallet instantly. This guide explores ‘What is Spot Trading on Binance’ comprehensively, helping you understand this popular method of trading cryptocurrencies.

Example: Imagine you want to buy 1 bitcoin (BTC) on Binance. You place a spot trade, and if the current market price is $30,000, you will pay $30,000 and immediately receive 1 BTC in your Binance wallet.

Spot trading vs. other types of trading

- Futures Trading: Unlike spot trading, futures trading involves contracts to buy or sell an asset at a predetermined price at a specified time in the future. The actual transfer of the asset does not happen immediately.

- Margin Trading: This involves borrowing funds to trade larger amounts than your initial investment, amplifying both potential gains and risks. Spot trading, on the other hand, only involves the assets you already own.

Key Features of Spot Trading

- Immediate Execution: Transactions are settled instantly, providing quick access to assets.

- Market Price: Trades are executed at the current market price, which is determined by supply and demand.

- Ownership: Buyers receive full ownership of the asset immediately after the transaction.

Spot trading on Binance offers a straightforward and transparent way to engage in the cryptocurrency market. It is ideal for both beginners and experienced traders who prefer to own their assets directly without dealing with the complexities of futures or margin trading.

3. Is Spot Trading the Same as Buying?

When you hear about spot trading on Binance, you might wonder, ‘What is spot trading on Binance?’ Spot trading, unlike simply buying cryptocurrencies, involves distinct differences that set it apart. Understanding ‘What is spot trading on Binance’ is crucial for anyone looking to engage in this method. Additionally, it’s important to distinguish spot trading from other forms, such as those in the futures market, as each offers unique features and benefits.

Spot Trading vs. Buying: The Basics

Spot Trading:

- It involves buying and selling assets for immediate delivery at the current market price.

- Transactions are executed “on the spot,” meaning ownership of the asset is transferred instantly.

- This is typically done on exchanges like Binance, where you can trade a variety of cryptocurrencies against other cryptocurrencies or fiat currencies.

Buying:

- Refers to purchasing an asset, such as a cryptocurrency, and holding it.

- The transaction is usually straightforward: you pay the price and receive the asset.

- It can be done on various platforms, including exchanges, brokers, and peer-to-peer services.

Example: When you engage in spot trading on Binance and buy Bitcoin (BTC) with USDT (Tether), you are executing a trade at the current market price, and the BTC is immediately transferred to your Binance wallet. This is different from simply buying Bitcoin from a broker, where you might not be engaging in an exchange environment or looking for immediate market pricing.

Key Differences

- Purpose:

- Spot trading is often aimed at taking advantage of market fluctuations to buy low and sell high, making profits from short-term price movements.

- Buying: Usually for long-term investment, where the goal is to hold the asset in anticipation of its value increasing over time.

- Execution:

- Spot trading requires active participation and monitoring of the market. Trades are made based on real-time prices.

- Buying typically involves a single transaction where you purchase an asset and hold it without immediate plans to trade it.

- Ownership and Transfer:

- Spot trading: immediate transfer of ownership upon execution of the trade.

- Buying: immediate transfer of ownership, but with a focus on long-term holding rather than frequent trading.

- Platform:

- Spot trading is conducted on trading platforms and exchanges like Binance, where numerous pairs and trading options are available.

- Buying: This can be done on various platforms, including exchanges, brokers, and direct purchases.

4. Why Choose Spot Trading on Binance?

Spot trading on Binance offers several key advantages that make it a preferred choice for many traders. Wondering what is spot trading on Binance? It’s a method where traders buy and sell cryptocurrencies at current market prices. Here’s a concise overview of why you should consider spot trading on Binance:

1. User-Friendly Interface

Binance’s interface is user-friendly and straightforward, making it accessible for both novice and seasoned traders.

2. A Wide Range of Cryptocurrencies

Trade a variety of cryptocurrencies, from popular coins like Bitcoin (BTC) and Ethereum (ETH) to numerous altcoins.

3. High Liquidity

High liquidity ensures the quick execution of trades at the best available prices for market participants.

4. Advanced Trading Tools

Access real-time charts, technical indicators, and various order types to make informed trading decisions.

5. Security Measures

Binance employs robust security features, including two-factor authentication and cold storage for funds.

6. Competitive Fees

Enjoy low trading fees, which can be further reduced by using Binance Coin (BNB) for fee payments.

7. 24/7 customer support

Binance offers round-the-clock support through live chat, email, and social media.

8. Educational Resources

Learn through Binance Academy’s extensive library of articles, videos, and tutorials.

5. How to Start Spot Trading on Binance

Curious about what spot trading is on Binance? Starting spot trading on Binance is a straightforward process that involves a few key steps. Here’s a simple guide to get you started with spot trading on Binance.

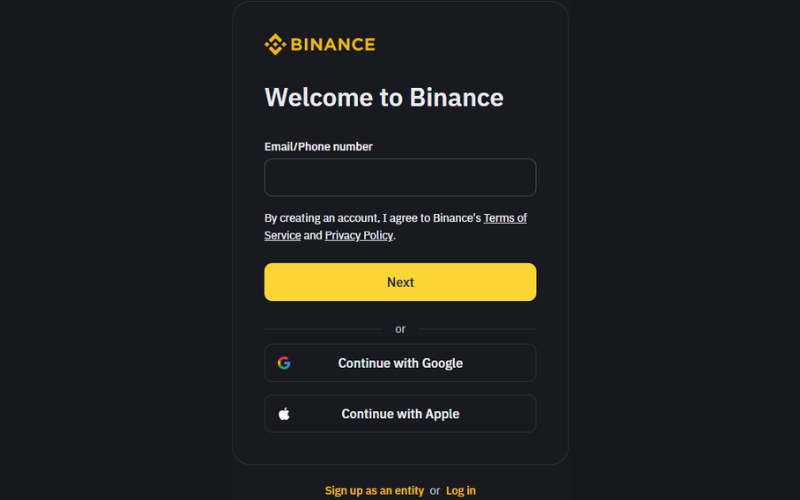

Step 1: Set up a Binance Account

- Visit Binance.com: Go to the Binance website and click on the “Register” button.

- Create your account: Enter your email address, create a strong password, and complete the registration form.

- Verify your email: Binance will send a verification email. Click the link in the email to verify your account.

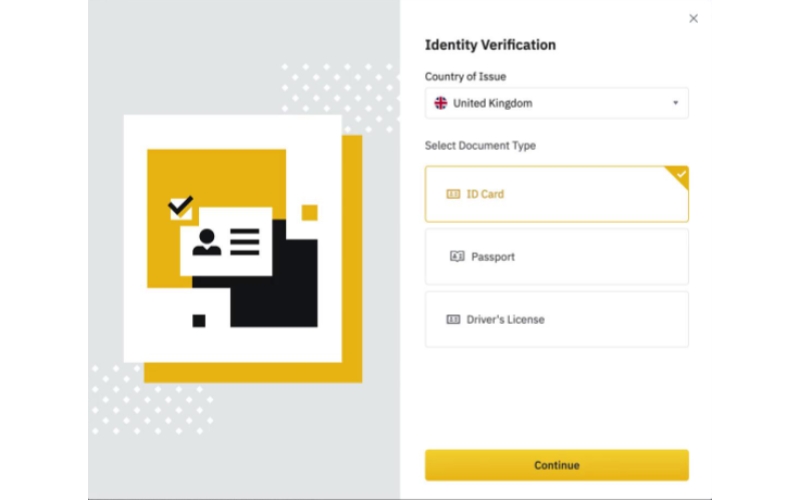

Step 2: Verify Your Identity

- Log in: After verifying your email, log in to your Binance account.

- Go to the Verification Section: Navigate to the user dashboard and click on “Identification” under the “Account” section.

- Submit Verification Documents: Follow the instructions to upload a government-issued ID and complete the identity verification process.

Step 3: Secure Your Account

- Enable Two-Factor Authentication (2FA): Go to the “Security” section and enable 2FA using Google Authenticator or SMS.

- Set Up Anti-Phishing Code: This adds an extra layer of security to your emails from Binance.

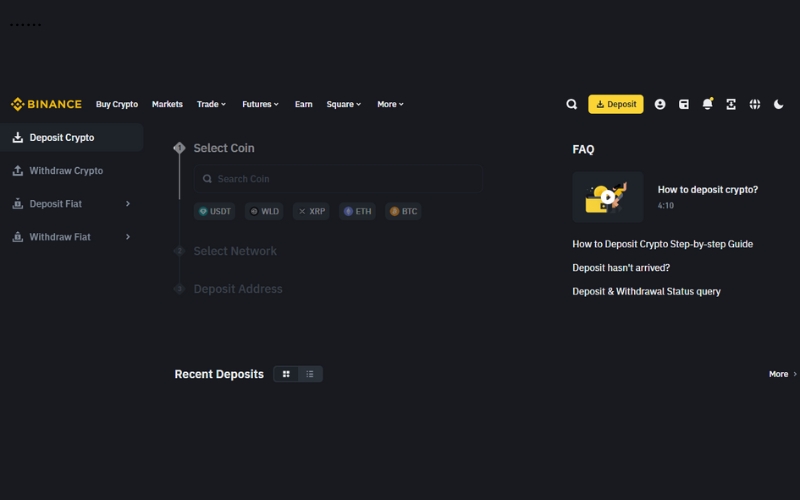

Step 4: Deposit funds

- Navigate to the wallet: Go to the “Wallet” section and select “Fiat and Spot.”

- Choose the deposit method: Click on “Deposit” and select the currency you want to deposit (e.g., USD, EUR, BTC).

- Follow Deposit Instructions: Follow the instructions to deposit funds into your Binance account.

Step 5: Start Spot Trading

- Go to the trading page: Click on “Trade” and select “Classic” or “Advanced” trading view.

- Pick your trading pair: Decide on the cryptocurrency duo you wish to trade (e.g., BTC/USDT).

- Confirm Your Order: Review the details and confirm the trade.

- Market Order: Buy or sell instantly at the current market price.

- Limit Order: Specify the exact price at which you intend to execute a buy or sell transaction.

6. Executing a Spot Trade on Binance

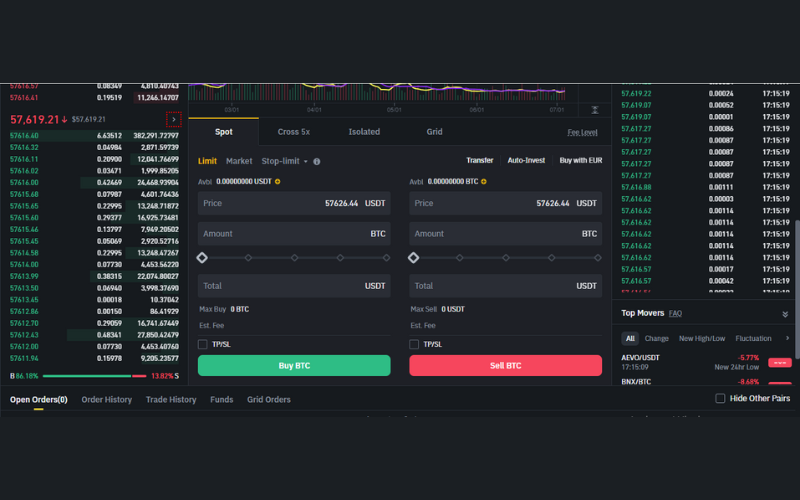

Executing a spot trade on Binance What is spot trading on Binance? It is a straightforward process. It involves navigating the Binance spot trading interface, selecting the appropriate trading pair, and placing your order. Here’s a step-by-step guide to help you understand and execute spot trading on Binance.

Step 1: Navigate to the Trading Interface.

- Log In to Your Binance Account: Enter your credentials to access your account.

- Go to the Trading Section: From the top menu, hover over “Trade” and select either “Classic” or “Advanced” trading view based on your preference.

Step 2: Select a Trading Pair

- Search for the Trading Pair: Use the search bar on the trading interface to find the cryptocurrency pair you want to trade (e.g., BTC/USDT).

- Select the pair: Click on the trading pair to load its trading details and chart.

Step 3: Analyze the market

- Review Market Data: Examine the price chart, order book, and recent trades to get an understanding of the market conditions.

- Use Technical Indicators: If desired, apply the technical indicators available on the chart to inform your trading decisions.

Step 4: Place a Buy Order

- Select Order Type: Determine if you prefer to place a market order or a limit order.

- Market Order: Buys or sells instantly at the current market price.

- Limit Order: Specifies the exact price at which you intend to execute a buy or sell transaction.

- Enter trade details:

- For a market order, enter the amount of cryptocurrency you wish to buy.

- For a limit order, enter the price and amount you want to buy.

- Submit the order. Click the “Buy” button to place your order.

Step 5: Place a Sell Order

- Choose Order Type: Select between a market order and a limit order for selling.

- Enter trade details:

- For a market order, enter the amount of cryptocurrency you wish to sell.

- For a limit order, enter the price and amount you want to sell.

- Submit the order. Click the “Sell” button to place your order.

Step 6: Monitor and Manage Your Trades

- Track Your Orders: Check the “Open Orders” section to monitor the status of your orders.

- Manage Your Trades: Cancel or adjust your orders as needed directly from the “Open Orders” section.

- Review Trade History: Access the “Trade History” section to review your completed trades.

Executing a spot trade on Binance involves navigating the trading interface, selecting a trading pair, analyzing market data, placing buy or sell orders, and monitoring your trades. By following these steps, you can efficiently execute spot trades and manage your trading activities on Binance.

7. How Do You Profit from Spot Trading?

Profiting from spot trading on Binance involves understanding what spot trading is, effectively utilizing strategies, and managing risks. Here’s a straightforward guide on how to profit from spot trading on Binance.

1. Buy low, sell high.

Purchase cryptocurrencies at a low price and sell them when the price increases.

Example: Buy Bitcoin at $30,000 and sell it at $35,000 to make a $5,000 profit.

2. Leverage market volatility

Take advantage of price fluctuations by trading during periods of high volatility.

3. Use technical analysis.

Analyze price charts and indicators like moving averages and RSI to predict price movements.

4. Fundamental Analysis

Evaluate the intrinsic value of cryptocurrencies by researching technology, team, and market demand.

5. Diversify Your Portfolio

Spread investments across different cryptocurrencies to minimize risk.

6. Set Stop-Loss Orders

Use stop-loss orders to limit potential losses by automatically selling when the price drops to a certain level.

Example: Set a stop-loss at $28,000 if you bought Bitcoin at $30,000.

7. Stay informed.

Keep up with the latest cryptocurrency news and trends to make informed trading decisions.

8. Strategies for Successful Spot Trading

Curious about what is spot trading on Binance? Spot trading on Binance can be highly profitable when coupled with effective strategies. Here’s an insider’s guide to mastering what spot trading is on Binance and achieving success in the dynamic cryptocurrency market.

1. Understand market trends.

Analyze market trends to make informed trading decisions. Analyze past data and chart trends to forecast future price changes.

2. Use technical analysis.

Employ technical indicators such as moving averages, RSI, and MACD to understand market conditions and identify potential entry and exit points.

3. Diversify Your Portfolio

Reduce risk by diversifying your investments across different cryptocurrencies. This way, poor performance on one asset won’t heavily impact your overall portfolio.

4. Set clear goals.

Define your trading goals, whether they’re short-term profits or long-term growth. Having clear goals helps you stay focused and make better trading decisions.

5. Manage risks

Implement risk management techniques such as setting stop-loss orders and only risking a small percentage of your capital on each trade.

6. Stay informed.

Stay informed on the newest trends and updates in the crypto world. Market news can significantly impact prices, so staying informed helps you react quickly.

7. Practice patience and discipline.

Avoid impulsive trading decisions. Stick to your trading plan and be patient, as market conditions can take time to move in your favor.

8. Use limit orders.

Limit orders enable you to set the exact price at which you wish to purchase or sell a cryptocurrency. This helps you avoid unfavorable price movements and ensures you trade at your desired price.

10. Common Mistakes to Avoid in Spot Trading

Spot trading on Binance can be profitable, but understanding ‘What is Spot Trading on Binance’ and avoiding common mistakes is the key to success. Beware of these common pitfalls:

1. Lack of Research

Entering trades without thorough research can lead to poor decisions. Always analyze the market, understand the asset, and keep up with the news.

2. Emotional Trading

Letting emotions drive your trades can result in significant losses. Adhere to your trading strategy and steer clear of rash choices driven by fear or greed.

3. Ignoring Risk Management

Failing to manage risks can lead to substantial losses. Always set stop-loss orders and avoid investing more than you can afford to lose.

4. Overtrading

Trading too frequently can increase transaction costs and reduce profits. Prioritize making high-quality trades over a higher volume of transactions.

5. Lack of Diversification

Investing all your funds in a single asset can be risky. Expand your investment portfolio to distribute risk across various assets.

6. Not Keeping Up with the Market

The cryptocurrency market is dynamic. Not staying informed about market trends, news, and updates can put you at a disadvantage.

7. FOMO (fear of missing out)

Jumping into trades because of FOMO can lead to buying at high prices and selling at low prices. Remain committed to your strategy, and steer clear of following fleeting trends.

8. Misunderstanding leverage

Using leverage without fully understanding it can amplify losses. Spot trading on Binance typically doesn’t involve leverage, but it’s important to know the risks if you decide to use it.

12. Conclusion

Spot trading on Binance, known as ‘What is Spot Trading on Binance,’ offers a straightforward and accessible way to engage in cryptocurrency markets. By understanding the fundamentals, employing effective strategies, and avoiding common mistakes, you can enhance your trading experience and increase your chances of success. Remember, continuous learning and staying informed are key to navigating the dynamic world of cryptocurrency trading.

14. FAQs

1. What is spot trading on Binance?

Spot trading on Binance refers to buying and selling cryptocurrencies at the current market price. It involves immediate transactions with the actual ownership of the assets.

2. How does spot trading differ from futures trading?

Spot trading involves the immediate exchange of assets at current prices, whereas futures trading involves contracts to buy or sell assets at a predetermined price on a future date without immediate ownership.

3. Is spot trading safe?

Spot trading on Binance is generally considered safe if you practice proper risk management, such as setting stop-loss orders and diversifying your portfolio. Nevertheless, similar to all investments, there are inherent risks.

4. Can I use leverage in spot trading on Binance?

No, spot trading on Binance does not involve leverage. You trade with the funds you have in your account without borrowing additional funds.

5. How do I start spot trading on Binance?

To start spot trading on Binance, create an account, deposit funds, navigate to the spot trading platform, choose the cryptocurrency pair you want to trade, and execute your buy or sell orders.

6. Where can I learn more about spot trading?

Educational resources like Binance Academy, books, courses, forums, and news sites.